Finducate

Concept

Finducate, a mobile app, helps University of Maryland students boost financial literacy. With user-centered design and thorough research, we created an intuitive interface, focusing on community features and tapping into existing resources. It empowers students to make informed financial decisions.

Role

UX Designer and Researcher

Team

2 Collaborators

Duration

24 Hours!

Tools

Figma, Miro, Canva

Background

Context

This project for CommunicateHealth, MD, was a part of UMD's UXTerps Makeathon. The work was completed in a span of 24 hours.

The Problem

Financial literacy, crucial for personal financial management, is lacking among college students, with only 53% feeling prepared. This gap leads to significant stress, as seen in 60% of graduate students, as per a study by CommunicateHealth.

What we set out to do

Our goals were to:

-

Empower users with structured and targeted resources for various finance topics.

-

Leverage UMD's existing student resources to offer one-on-one financial planning advise.

Core Challenges

-

The wealth of information available is often confusing or hard to understand.

-

There is a lack of awareness about financial planning among students early in life.

-

Students find money to be a difficult topic to discuss among themselves.

My Contribution:

I solely conducted the interviews and competitive analysis for this project. My teammate and I divided the wireframes and I was responsible for the home, community, and expert advice screens. The ideation for the wireframes and app features was a team effort and I contributed equally.

Explore the App

The Prototype

Research

Exploring the current market for Financial Literacy

Financial literacy is the possession of the set of skills and knowledge that allows an individual to makeinformed and effective decisions with all of their financial resources. We take a look at what's currently available:

-

Online courses (Coursera's "Financial Literacy" course)

-

Financial literacy websites with study materials (Investopedia's educational articles)

-

Articles ("10 Tips for Financial Planning" on Forbes)

-

Books ("Rich Dad Poor Dad" by Robert T. Kiyosaki)

Broadly, the topics were:

User Interviews:

We spoke to the students at the University of Maryland of ages 18 -26.

Interview Goals:

-

Current patterns of finance management

-

Resources used for financial education

-

Challenges faced while learning

-

What they think would work

Interview Script

-

How do you currently manage your finances, such as budgeting, saving, and investing

-

Have you ever sought out financial education or advice? If so, what resources have you used and how helpful were they?

-

What areas of personal finance do you feel least confident or knowledgeable about?

-

Have you ever experienced any financial scams or fraud? If so, can you share your experience and how you resolved it?

What we found

Tools Currently Used

Excel and MoneyManager apps were used

Experience with Fraud

Student frauds are common, but there is no knowledge about how to protect self

Taxes are Confusing

Tax is currently filed by parents/someone else and the various forms are confusing.

It's embarassing to talk to people

Students are shy with their money, and it's difficult to talk to peers about it

UMD has a student-led tax service

Students volunteer to file taxes for others in exchange of credit. Its called Terptax

Structured Resources

Users seek personalized financial advice and concise resources

Personas - Consolidating our findings

Research Insights

Need for accessible and credible resources and advices

Need for personalized recommendations

Requirement of simple and understandable content

Peer discussions for quick inputs and advice

Key Features

Money Personality Quiz

Personalized Recs

Educational Resources

Discussion Forums

Live Expert Advice

Wrapping Up

What I Learned:

-

Working on a quick schedule to take a design from 0 to 1.

-

Implementing clear task delegation for efficient workflow in high-pressure scenarios with constrained resources.

What I could've done differently:

-

Allocate more time for participant interviews to gather a broader range of insights.

-

Prioritize usability testing to ensure the app's effectiveness and user-friendliness.

-

Implement AI gradually and ensure thorough testing before full-scale deployment.

-

Explore additional partnerships or diverse sources for content curation beyond Motley Fool.

-

Offer a wider variety of educational resources beyond webinars, such as online courses or interactive modules.

-

Negotiate for more comprehensive financial literacy courses or extend the mandatory duration of existing courses in university tie-ups.

Explore the App

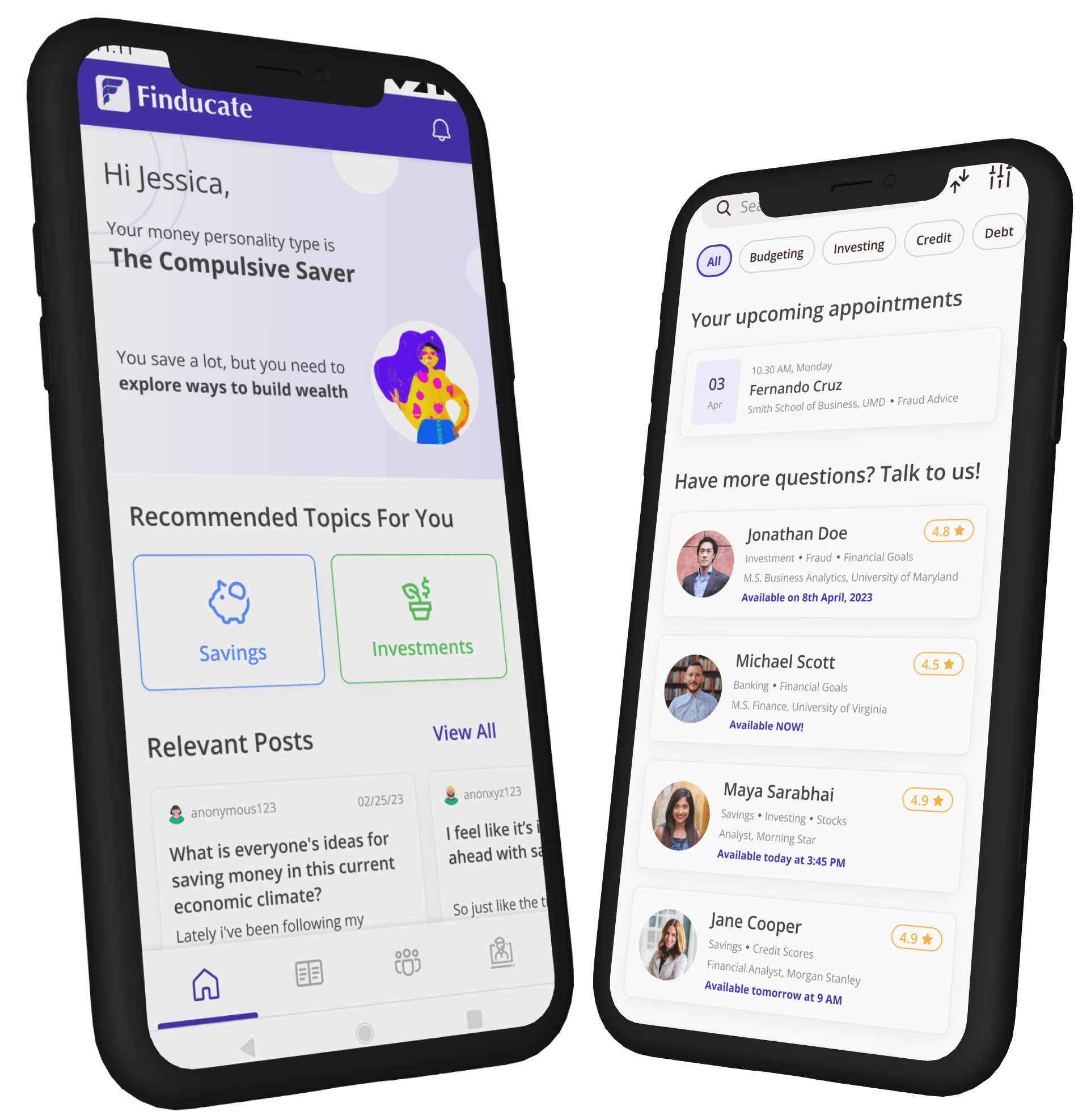

Personality Quiz: The onboarding consists begins with a money personality quiz to assess goals, behaviour - to drive further reccomendations

Home: Brings the education, community, and consultation together on screen. This includes recommended topics, relevant forum posts, upcoming appointments and relevant people to meet.

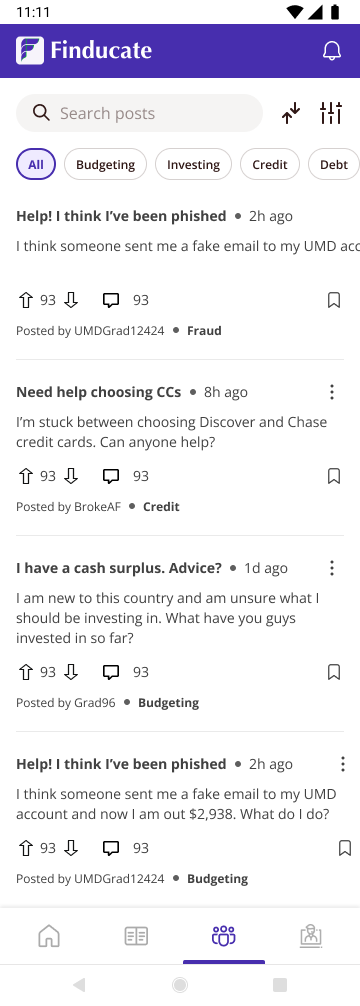

Community: A common forum to share experiences and any questions one might have about money.

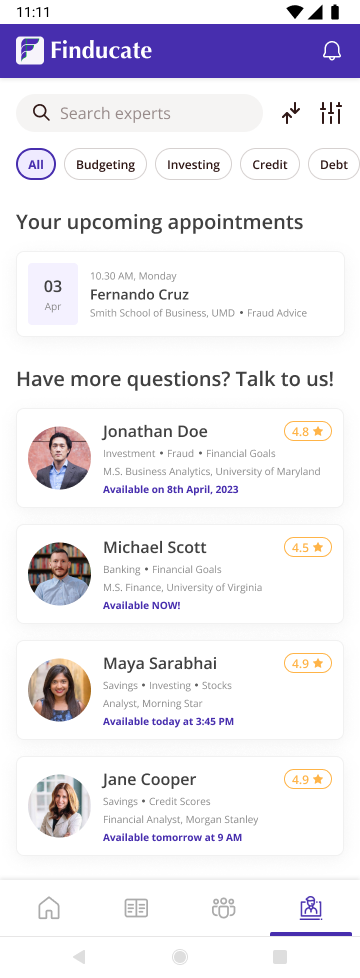

Expert Advice: UMD can use this app as a volunteering opportunity for its financial advisor course. Users can make appointments with enrolled students, who get credit for their services

Education: The user can choose from topics to learn about and go through a structured and curated series of media, either original or sourced from other investment websites.